Anyone who owns a pet knows how much joy they can bring to your life. And fortunately, pet adoptions saw a huge increase in 2020. According to data from PetPoint, pet adoptions increased by 85% in March 2020.

But it’s easy to adopt a pet without fully considering the financial commitment. According to the ASPCA, the average dog owner spends between $737-$1,040 per year. Cat owners spend an average of $809 per year.

Of course, most pet owners will agree that the benefits outweigh any costs. But it’s important to consider the costs so you can ensure you can actually afford to adopt a pet.

Pet Expenses to Consider

With a little planning, it’s possible to give your pet everything they need and stick to your monthly budget. But, if you’ve never owned a pet before, it’s hard to know what those expenses even are.

If you’re considering adopting a pet, here are seven expenses you should plan for:

1. Adoption costs

Regardless of how you adopt a pet, you can plan on paying some one-time adoption costs. How expensive these costs are will really depend on how you adopt your pet.

If you adopt through a local shelter, you’ll pay an adoption fee and administrative fee. This usually covers the initial veterinary exam and costs to spay or neuter the pet.

According to the Animal Humane Society, here are the standard adoption fee ranges:

- Dogs and puppies: $118-$667

- Cats and kittens: $34-$276

- Birds and rabbits: $8-$173

If you choose to buy a pet from a pet store or breeder, you can expect to pay anywhere from $300 to $1,500. And depending on the breed, buying a show-quality pet can cost up to $5,000.

2. Supplies

Unless you’ve been a pet owner in the past, you’ll need to invest in supplies before bringing your new pet home. Dogs tend to be the most expensive and require the following supplies:

- Kennel

- Food

- Food dish

- Water dish

- Collar

- Harness

- Leash

- Brush

- Dog bed

Cats will need a bed, scratching post, a litter box, and litter. Some of these will be one-time fees, while others will be ongoing costs.

Buying supplies for your pet can quickly get out of hand. For me, I was able to find a good food and water dish for all of my animals from the Dollar Tree.

3. Food

One of the biggest monthly expenses you’ll need to plan for is food. And the bigger your pet, the more money you can plan to spend on food. Large dogs will need to eat more food every day, whereas a smaller dog or cat won’t eat as much.

Animals with dietary restrictions or allergies will also increase the cost of their food.

One of the best ways to save money on food costs is by using a pet food delivery service. For instance, by setting up an auto-shipment with Chewy, you’ll save 35% on your first auto-shipment and 5% on repeat deliveries (this is what I do).

4. Medical costs

When you adopt a pet, you’re also taking responsibility for their medical care. This means you’ll need to find a nearby veterinarian and commit to taking your pet for their yearly exam.

You’ll also need to pay for things like heartworm medication and flea/tick medication. Your vet may be able to help you find a way to save money on these expenses.

Hopefully, the yearly checkups and preventative medicine will be the extent of your medical costs. But just like people, animals can have health problems. And depending on the severity of the situation, medical bills can quickly add up.

For instance, if your pet ends up needing surgery, you could end up spending thousands of dollars on vet bills. If you’re concerned about unexpected medical bills, you might consider paying for pet insurance. This will be an added monthly cost, but it can save you from a huge vet bill down the road.

5. Toys

Pets need mental stimulation, so you’ll want to invest in toys and other supplies. Just be careful when you’re buying toys for your pet because it’s really easy to overspend in this area.

Ropes, chew toys, and mentally stimulating toys are great. Some dogs, for example, are chewers by nature. They might require more heavy-duty toys if they seem to be chewing up the stuffed toys.

6. Grooming

Occasionally, you may want to pay for your pet to be groomed. This is an expense mostly reserved for dog owners since cats do a good job of grooming themselves.

To save money in this area, don’t automatically go for the most expensive grooming treatment. Many of these services are overpriced and unnecessary. And if you have the time, you can save some money by learning how to groom your dog yourself.

7. Unexpected costs

And finally, there are always unexpected costs that come up when you own a pet. For instance, if you adopt a cat, you may need to pay for furniture repairs after it scratches up your couch.

Ongoing puppy training classes are something that you may need to consider for your puppy. If you occasionally travel for work, you may need to pay to board your pet. If you and your family decide to go on a family vacation with your pet, most hotels require a pet cleaning fee, and some even charge a nightly rate for your pet.

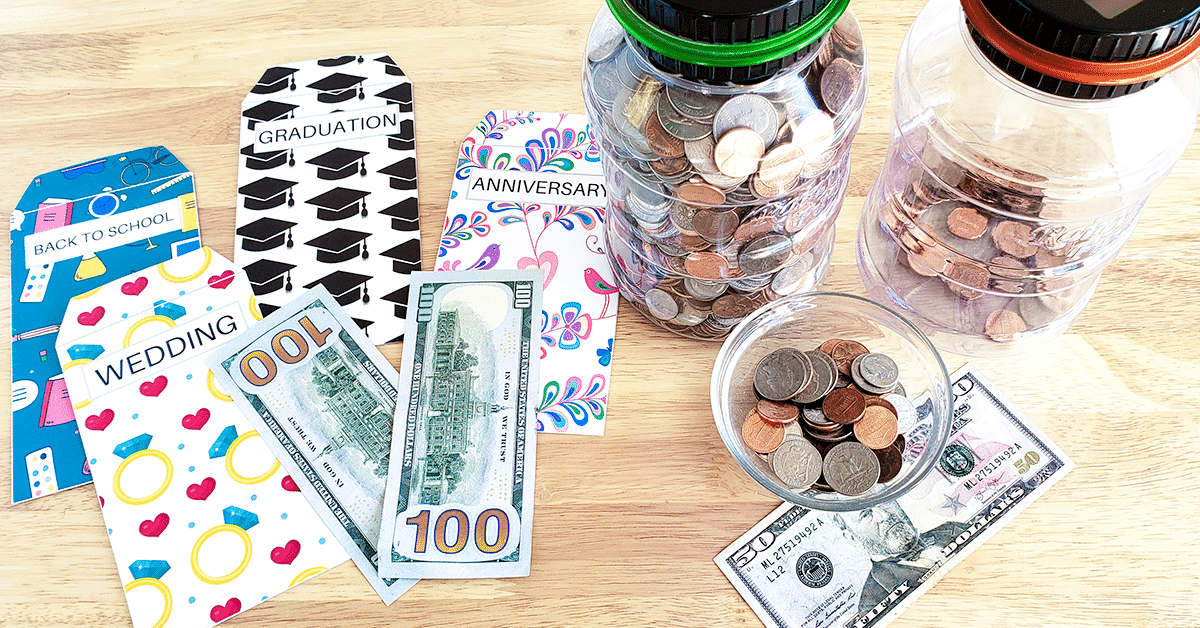

The best way to deal with unexpected pet costs is by setting up a pet sinking fund. Every month, set aside a little bit of money toward your pet sinking fund. That way, if an unexpected cost does come up, you’ll have already planned a way to cover it.

The Bottom Line

Owning a pet is a big responsibility, and you want to know you’re giving your pet everything it needs. While it’s hard to know exactly how much you’ll spend, there are some general expenses you can plan for.

Ensure that you plan very well ahead if you're looking to bring a furry friend home. The costs associated with pets can easily be overlooked, so be sure to stick to your budget and even create mock budgets to ensure you can afford to own a pet responsibly.