If you’re like 76% of Americans, you understand the joy that comes with owning a pet. But let’s be honest — being a pet owner comes with a lot of responsibility. Not only do you have to meet your pet’s basic needs, but should they become sick or injured, you have to make sure they receive medical care.

According to CNBC, roughly one in three pets will need emergency medical care within the following year. The average unplanned veterinarian visit can range between $800 and $1,500.

Some people just don’t have an extra $1,500 lying around to spend on medical expenses for your pet. This is why increasingly, many people are turning to pet insurance. But are the costs really worth it?

How Does Pet Insurance Work?

With most pet insurance plans, you’ll pay a monthly or annual fee in exchange for a certain amount of coverage on your pet. Most pet insurance plans won’t pay for routine visits, but rather, the insurance is designed to help cover unexpected costs.

This could include the following emergency scenarios:

- An injury or illness

- Diagnostic testing

- Surgery

- Rehabilitation

- Cancer treatment

Most plans come with a deductible, which is a certain amount you have to pay before the insurance kicks in. Typically, the higher your deductible is, the more you’ll be reimbursed on your plan.

What is the Cost of Pet Insurance?

You need to consider two main costs when it comes to pet insurance: your monthly expenses and your deductible. These fees will vary depending on the type of pet you have and their overall health history.

The average monthly costs seem to fall between $30-$40 per month per pet. You can pay a little less if you’re willing to sign up for an annual plan. You’ll have to contact the company directly to receive a personalized quote.

As for the deductible, these typically range between $100-$1,000. Some companies will let you choose your own deductible. Depending on how high your deductible is, that company will reimburse you for a percentage of your costs.

Pros and Cons of Pet Insurance

Here are some of the pros and cons of taking out pet insurance:

Pros:

- You could end up saving money: If your pet ends up needing surgery or receives a cancer diagnosis, then pet insurance could be a lifesaver. This will save you from having to choose between finances and giving your pet the medical treatment they need.

- You can choose your vet: Unlike health insurance, there are no in-network or out-of-network providers. That means you can choose your own veterinarian, not pick from an arbitrary list that the company gives you.

- The monthly payments are low: For most people, the monthly payments will range from $30-$40 a month, which makes them affordable for the average person.

- Low deductibles: Most pet insurance deductibles are pretty reasonable, especially in comparison to how much you could pay for an unexpected vet bill.

- Peace of mind: For more people, pet insurance's biggest benefit is the peace of mind that comes with it. If your pet is ever sick or injured, you’ll know you can afford to get them the care they need. According to the NAPHIA, pet owners who purchased pet insurance are more likely to seek out medical care for their pets.

Cons:

- It doesn’t cover everything: Unfortunately, pet insurance is not going to wipe out all of your veterinary bills. Most will not pay for routine visits and exams, so if you have a pretty healthy pet, you may not end up saving that much money. Also, f your pet has a hereditary condition, your insurance is unlikely to cover that.

- You have to wait for reimbursement: One of the biggest disadvantages of pet insurance is that if an emergency arises, you have to pay the vet bill yourself and then wait for the company to reimburse you. So you’re really at the mercy of that company and whether they feel like your visit fits within the criteria of your plan.

- You’ll probably pay more than you realize: The odds are that pet insurance won’t end up covering as much as you think it will. According to the New York Times, pet owners with pet insurance still end up paying for about 20% of their pet’s expenses.

Should I Get Pet Insurance?

If you’re on the fence as to whether or not to buy pet insurance, there are a couple of different things you should consider. First, you should consider whether or not you’d be able to pay for a financial emergency for your pet.

Emergency surgery or a severe medical diagnosis could end up costing you thousands of dollars. If you think you’d have a hard time footing the bill without resorting to credit cards, then it may make sense to buy pet insurance.

There are other instances when paying for pet insurance is a good idea. For instance, if you adopt a rescue dog and you’re unfamiliar with their medical history, then pet insurance can give you some additional peace of mind.

The Bottom Line on Pet Insurance

I understand the appeal of taking out pet insurance. You love your pet and want to know that they’ll be taken care of in an emergency. There’s a certain peace of mind that comes with knowing your emergency vet bill will be covered.

Featured Post

Saving for the Unexpected: How to Protect Your Family with an Emergency Fund

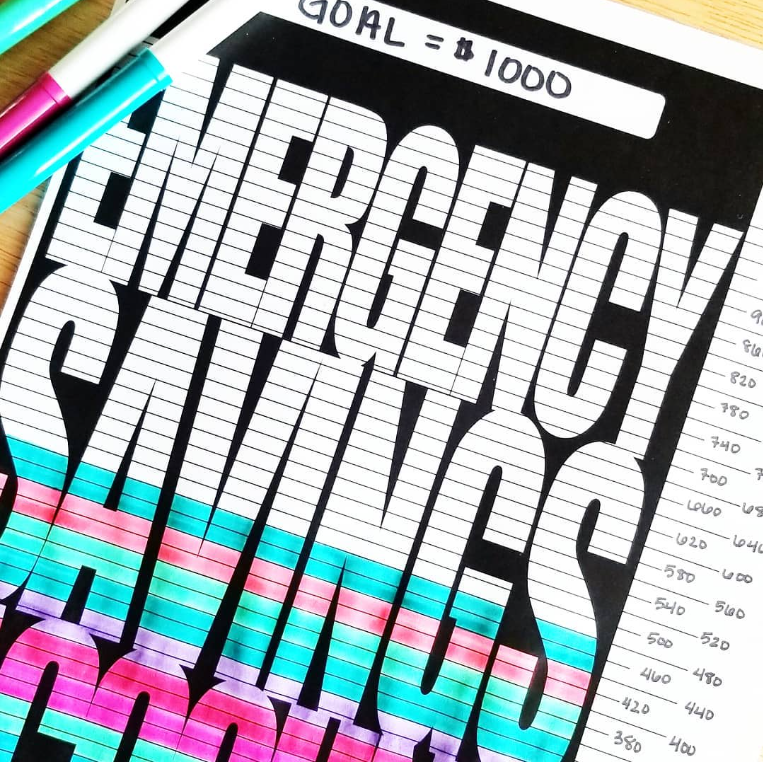

Read PostThat being said, I think there are better ways to plan for these types of financial emergencies. Instead of paying $40 per month to a company, why not save that money in an interest-bearing savings account, like the CIT Saving Builder? Then if an emergency does strike, you can take care of it from your savings instead of hoping that company will agree to reimburse you. For me, I'm electing to have pet insurance for my animals until I build up a healthy pet emergency fund.

Ultimately, it comes down to your personal preferences and what you feel comfortable with. If you do decide to go forward with pet insurance, do your homework first. Compare companies and when you find one you like, make sure you understand your plan's specifics.

Have you ever used pet insurance? If so, what was your experience like? Do you feel like it was worth the money you spent?