Social Security was never meant to be the primary source of retirement income for people, but unfortunately, many who retire do just that. It is important to invest for retirement, and you might want to consider an index fund, which is one of several options for you.

Back in 1975, John Bogle unveiled the first index fund. And very few people could have predicted the investing revolution that would follow.

In the last 40-plus years, index funds and ETFs (exchange-traded funds), have grown immensely popular, taking nearly half of all U.S. investing dollars. Whether you're new to investing or a seasoned veteran, index funds are one of the best investment vehicles on the market today.

Let's take a look at what index funds are and the advantages that they offer investors.

What is an index fund?

Index funds are pools of investments that track a particular market index. For example, the S&P 500 index funds track the S&P 500 index. There are separate index funds for each type of market index. Here are a few of the most popular market indexes for index funds to track:

- Dow Jones Industrial Average

- NASDAQ Composite Index

- Russell 1000 Index

- Russell 2000 Index

- 10 Year Treasury Note Yield Index

- 30 Year Treasury Bond Yield Index

- Gold/Silver Index

- Oil Index

Index funds are designed to match the performance of whichever index they are tracking. So if the S&P 500 is up 12% for the year, the S&P 500 index funds will have a very similar return (minus expense ratios or brokers fees). They can also perform better (or worse) than the average, depending upon the ratio of each stock held.

How index funds minimize risk while cutting costs

Index funds offer two huge benefits: They reduce your risk and your expenses. Let's take a look at why that's the case.

Minimizing risk

Do you know why index funds are considered one of the best ways to reduce your risk as a stock market investor? Because, when you invest in individual stocks, your success or failure is entirely wrapped up in one company's performance. But as an index fund investor, you're essentially betting on the economy as a whole.

Here is a way to picture it: When you invest in an S&P 500 index fund, it's no problem if one of the stocks drops significantly. As long as the overall market rises, then your portfolio should increase, too. Over time, many investors have found it to be a good bet. The S&P 500 has averaged an annual return of nearly 10% since it started back in 1957.

Cutting costs

Index fund investing is often called “passive investing.” With an actively managed fund, managers have to make decisions about what stocks will be part of the investment portfolio. With an index fund, they simply track a market index. Because of this, they don't need to pay fund managers to pick the stocks to make up the fund.

Because it is not actively managed, index funds can offer much lower expense ratios than the typical actively managed fund. An expense ratio is the percentage of a fund's assets that are used to pay for things like the administration and management of the fund, as well as advertising, marketing, and other expenses it takes to operate the fund.

While actively managed mutual funds generally charge from 0.50% to 1.5%, index funds often have ratios below 0.20%. You are basically saving about 2 to 7 times in expenses.

Why fund expenses matter

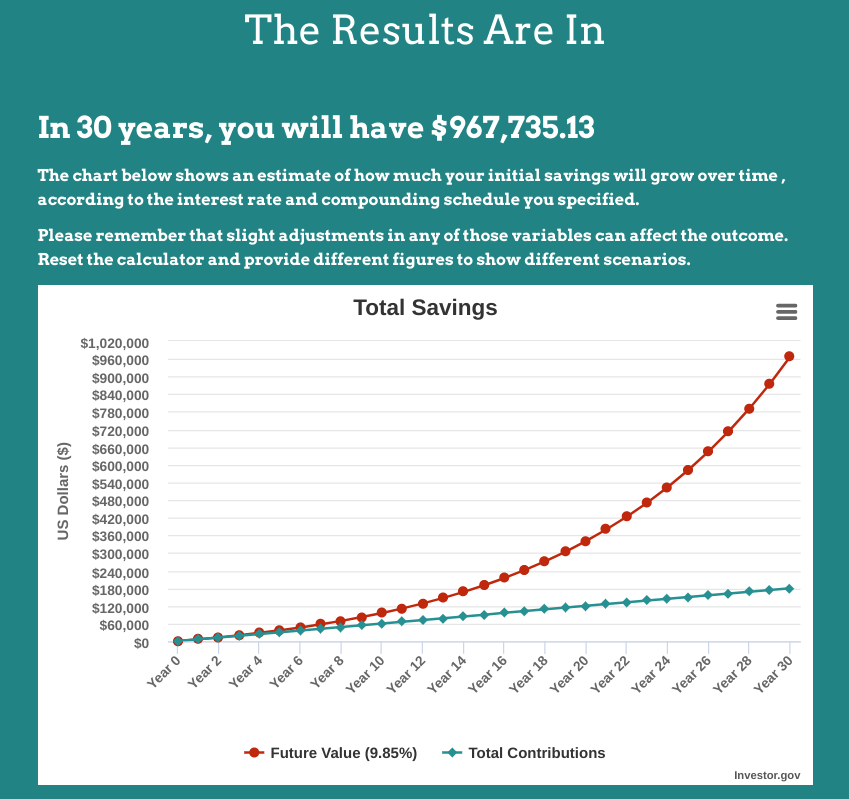

The expense differences described above might seem minimal. But they can make a big difference over time. For example, let's say that you invest $500 per month in both an index fund and a mutual fund over 30 years. Let's also assume that both funds net you a 10% annual rate of return. But the index fund has an expense ratio of 0.15%, and the mutual fund's expense ratio is 0.90%. That's a difference of 0.75%. It drops the overall return of the index fund to 9.85% and the mutual fund to 9.20%.

It might not sound like a big deal, but it could be more significant than you think. Using the compound interest calculator from Investor.gov, we see that the index fund would grow to $967,000 over 30 years.

And the mutual fund? Its final value would total just over $840,000.

That's a difference of $124,000 in your retirement portfolio, all due to a cost difference of only 0.75%!

And, remember, those calculations only take expense ratios into account. Mutual funds that charge expensive sales loads will compare even less favorably to index funds. Consider these loads to be a commission paid to buy or sell mutual fund shares.

Do index funds perform well?

Index funds have lower expense ratios, but how do they perform compared to actively managed mutual funds? Well, an index fund will generally match the index. It could vary a little depending on the ratio of stocks owned. If Stock A has the highest rate of return and you own a greater percentage than is represented in the fund, then there is a good chance the index fund will outperform the index.

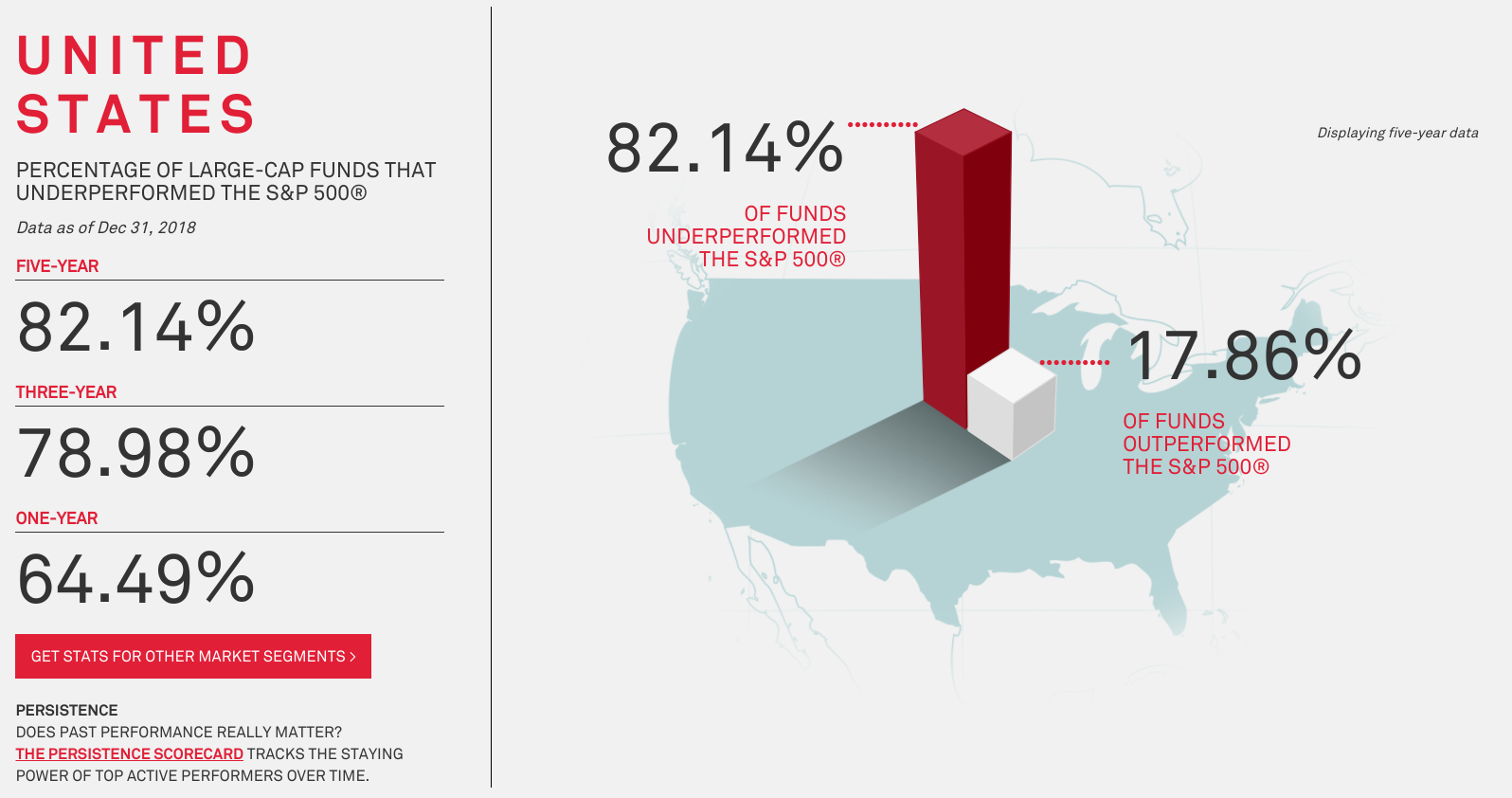

However, SPIVA Statistics shows 82.14% of actively managed funds have underperformed the S&P 500 over the past five years. So, outperforming the market is the exception rather than the rule. It turns out the “Average Joe” isn't the only investor who struggles to outperform market indexes– so-called “expert” fund managers do, too.

So passive investing is not only more cost-effective than active investing — but you'll typically enjoy better portfolio performance as well.

If you're ready to start index fund investing, I recommend opening a brokerage account, choosing a market index that you'd like to invest in, and finding the specific index fund that your broker offers, which tracks that particular index.