There’s no nice way to put it: Inflation stinks.

Every time inflation rises, your money is worth less than before. Because raises usually don’t keep pace with inflation, this means that your budgets are going to be readjusted.

This is especially apparent if you look at food costs. On average, the cost of food is up 9% compared to this time last year. Specific items, such as chicken, cost even more by as much as 16%.

If you keep your food budget the same, then you’re going to be able to afford less food than before. But if you want to keep purchasing the same amount of food for your family, then you’re going to have to increase your food budget by at least 9%.

Either way, it’s not a good situation to be in.

While we can’t control inflation, there are steps you can take to modify your budget. Below are several strategies on how you can adjust your budget accordingly.

5 Ways You Can Tackle Inflation Immediately

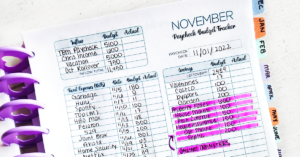

First things first, if you don’t already have a budget, create one. Today!

Here’s the reality: It’s going to be very difficult to actually save money (and keep doing it) without a written down budget. Even if you think you can keep track of it in your head, putting it on paper will help you better spot areas for improvement. Trust me.

If you don’t already have a budget, here is a FREE Budget Crush Workbook I created that can help! It only takes four easy steps. I would also encourage you to read my previous articles on budgeting.

Once you’ve got a budget, do these 5 things to tackle inflation:

Strategy #1: Boost Your Income Wherever Possible

At its core, budgeting really comes down to two things: Money in vs. money out.

Again, we can’t control inflation, but we can control both of these factors.

To boost your income, consider:

- Asking for a raise. It’s a tough job market right now – for businesses. Many companies are struggling to fill open positions. This means that most companies are going to try to make current employees happy, because they know it might be difficult to fill the position. If you’re going to ask for a raise, compile a list of reasons why you believe you deserve one. Perhaps you’ve been taking on extra projects recently. Maybe you didn’t get a raise last year. Or maybe you’ve learned new skills that have made you a more valuable employee. The better you can “make your case,” the more likely your manager will listen and reward you with a raise!

- Starting that side hustle you’ve dreamed of. Most of us have thought about pursuing a side hustle at one point or another. If you're tight on cash, starting that side hustle will help you alleviate some of that budgetary pressure. The best part? You can do it on your own schedule. You’re essentially your own boss! There are many entrepreneurs whose successful businesses started as a side hustle. You never know where this opportunity might take you. Check out my previous articles on how to start a side hustle.

- Taking on extra shifts at work. If a raise isn’t in the cards and a side hustle doesn’t interest you, consider working extra shifts or asking for overtime.

- Searching for a new job. Since companies are struggling to fill open positions, this means that it’s a good time to look for a new job. In most cases, you’ll have greater negotiating power in terms of your wage, hours, and benefits. Remember, searching for a new job doesn’t necessarily mean that you’re for sure going to leave your current job. It’s just a good idea to keep your options open. Plus, knowing what similar positions at other companies are paying will help you make sure you’re getting paid your worth!

Strategy #2: Live Like You’re in College

Remember when you were in college and ramen noodles weren’t that bad?

I’m not saying that you and your family have to eat ramen noodles and leftover pizza for every single meal. However, most of us have raised our standards of living a lot since college.

For example, many people purchase pre-cut fruit from the grocery store instead of cutting the fruit themselves. While this is convenient, you’re paying for that convenience. Oftentimes, a small plastic tub of pre-cut fruit is more expensive than buying the actual fruit! By buying fruit and cutting it yourself, you’re saving money and getting to enjoy fresher produce.

Maybe you’ve started buying name-brand cereal since college, but is the generic brand really that much worse? Or perhaps you get takeout pizza instead of getting a frozen pizza and baking it yourself.

I’d wager that most of us could find ways to cut back while grocery shopping.

This “living like you’re in college” mentality doesn’t just apply to food and groceries.

When you were in college, you paid close attention to subscription services you didn’t need. As adults, however, we tend to keep recurring subscriptions even if we haven’t used them in months! So reevaluate:

- What streaming platforms you regularly use

- Whether you’re fully utilizing your cellular data plan

- Any subscription boxes (clothing, food, beauty products, etc.)

- Recurring orders on Amazon

- Etc.

In other words, if you’re not using it, lose it!

Strategy #3: Reduce the Cost of Your Debt

Yes, it’s important to pay off your debt and to accelerate debt payoff when possible.

But let’s take things a step further.

Why not reduce how much your debt is “charging” you through interest?

If you’re in credit card debt, there are personal loans that usually have more favorable terms and much lower interest rates compared to credit cards. Transfer your balance to a loan instead and you’ll save lots of money from interest charges. There are even some credit cards with no transfer fee and 0% introductory offers for up to a year! Of course, the most important thing is to stay out of debt once you pay it off!

Home loans, car loans, and personal loans can also be refinanced if you can find a better deal. Lower interest rates mean lower monthly payments, so this will give you more breathing room in your budget.

However, make sure to do the math and double-check the fine print before refinancing. For example, prepayment penalties can offset any savings you were hoping to achieve. Just because something is a lower interest rate, it doesn’t always mean it’s the better deal. Transfer fees and other penalties can really add up.

Strategy #4: Check Your Budget Weekly

Most people tend to work on a monthly budget.

But when money is tight, it can be a good idea to check in with your budget every week. This will give you a better pulse on where your money is going and whether you’re on track to meet your monthly spending and savings goals.

By checking your budget weekly, you can see if spending is creeping higher in one category than intended. This allows you to adjust another budget category accordingly.

Furthermore, this is a psychological trick that can keep you motivated! By prioritizing your budget, it’s going to influence other decisions you make in your life. For example, the more conscious you are about your electric bill, the more likely you are to turn off a light when you leave a room or adjust the thermostat whenever you leave the house.

To be intentional about your budget check-ins, ask yourself:

- Am I on track to be within my spending limits?

- Do I need to adjust any category limits to keep my overall budget in check?

- Are there categories where I repeatedly over/under spend?

- What else can I do to lower costs in each category?

These questions will help you maintain a healthy budget and avoid any unexpected surprises.

Strategy #5: Continue to Focus on the Future

Inflation is a challenging topic because it affects right now.

Not tomorrow… but today.

If you need to temporarily stop saving or investing for the future because of inflation, that’s okay as long as you have a purpose. It’s better to temporarily stop those contributions than to miss a mortgage payment or start missing credit card payments.

But “temporarily” is the keyword.

Most advice on budgeting for inflation focuses on today, but it’s important that you don’t sacrifice your financial future.

Continue to prioritize saving, especially in a high interest savings account, and investing for future travel plans, scholarship funds, and your eventual retirement.

Inflation costs everyone more money, but it doesn’t have to cost your financial future. Stick to your budget and keep chugging along. You’ve got this!

To connect with other readers who are also trying to deal with inflation, I encourage you to join the TBM Family on Facebook. Hope to see you there!