If you’ve been to the store recently, you may have noticed a sign talking about the national coin shortage. In June, the Federal Reserve announced that the supply system for coins had been disrupted.

The coin shortage is yet another side effect of the ongoing Coronavirus pandemic. Since March, fewer people have been visiting restaurants and doing their shopping in-person. ATM usage is down, and contactless payments are up.

All of this leads to fewer coins and cash circulating through the economy. Which has led many people to wonder if a cashless society will be part of the “new normal” we’re all experiencing.

Personally, I am not in favor of a cashless society. I think the disadvantages outweigh the benefits, and a true shift away from cash would hurt many people. But I still want to have the conversation and look at some of each scenario's pros and cons.

What is a Cashless Society?

In a cashless society, we’ll rely solely on electronic payments. Banks will no longer produce cash, and every transaction will be done using a smartphone or card.

Many countries have been embracing cashless policies for years. Finland, Sweden, and South Korea are poised to become cashless countries in the next few years.

Here are some of the most popular forms of cashless payments:

- Credit and debit cards: Credit and debit cards are the most popular payment options for most people. And many people are embracing contactless cards, where you wave your card in front of an electronic reader instead of swiping.

- Mobile wallets: Mobile wallets are a secure way to pay electronically. Instead of carrying your credit and debit cards in your wallet, you can save them on your smartphone.

- Payment apps: Payment apps are a popular way to send money to other people. Apps like PayPal, Venmo, and Zelle allow you to send money to other people within minutes.

- QR codes: Paying via QR codes is less common in the U.S., but it’s common in countries like China. You’ll scan the merchant’s QR code to complete the payment transaction.

The Benefits of a Cashless Society

If you’re in the position to take advantage of a cashless society, then you might find it more convenient and safer. Here are some of the pros of a cashless society:

- Cashless payments are quicker: If you’ve ever stood in line behind someone paying with a check, you might appreciate the benefit of faster payment transactions. Cashless payments are quicker, leading to increased efficiency in stores and better customer experience overall.

- Reduced theft in businesses: Anytime you carry cash, you’re at a higher risk for theft. Once cash is stolen, it’s hard to track and recover that money. Businesses that eliminate cash would be reducing their risk of theft, both by employees and potential break-ins.

- Reduced financial crime: In comparison, electronic transactions are much easier to track. When there’s an automatic paper trail, it’ll be easier to catch crimes like money laundering and tax evasion.

- Easier to travel abroad: I know traveling abroad isn’t top of mind for most of us these days. But hopefully, it’ll be an option again at some point. And traveling internationally is much easier when you don’t have to carry cash. Your mobile device will handle the exchange rates for you so you can enjoy your trip.

- Less germs: Cash is extremely dirty. It's been said that cash can carry more germs than your toilet, and it can even carry certain viruses over two weeks. Right now, this might be the main reason why switching to a cashless society is such a hot topic.

The Disadvantages of a Cashless Society

While I acknowledge the benefits of a cashless society, I think the disadvantages outweigh them. Here are some of my biggest downsides about a cashless society:

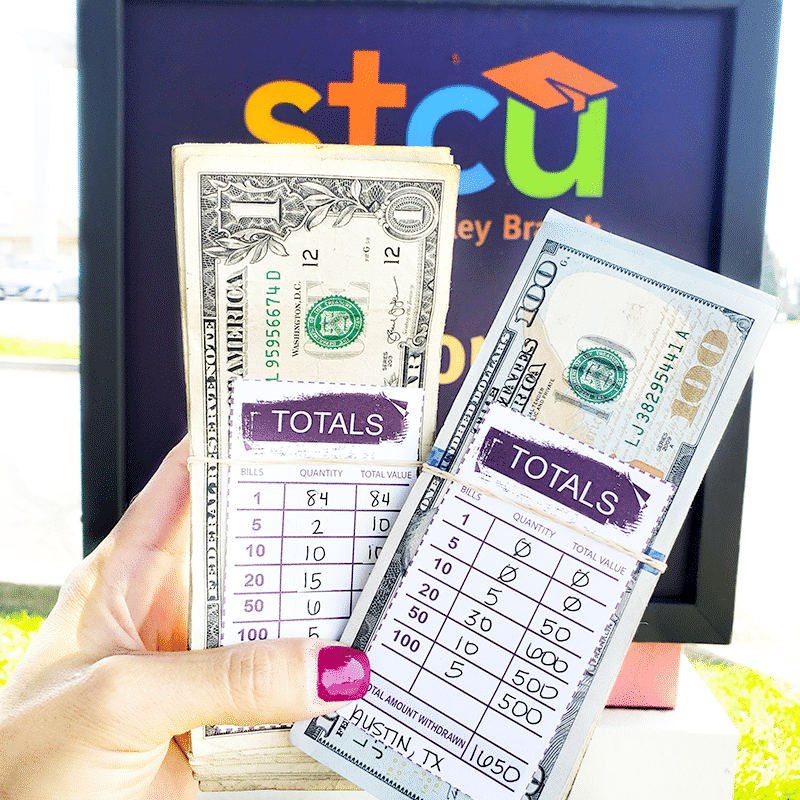

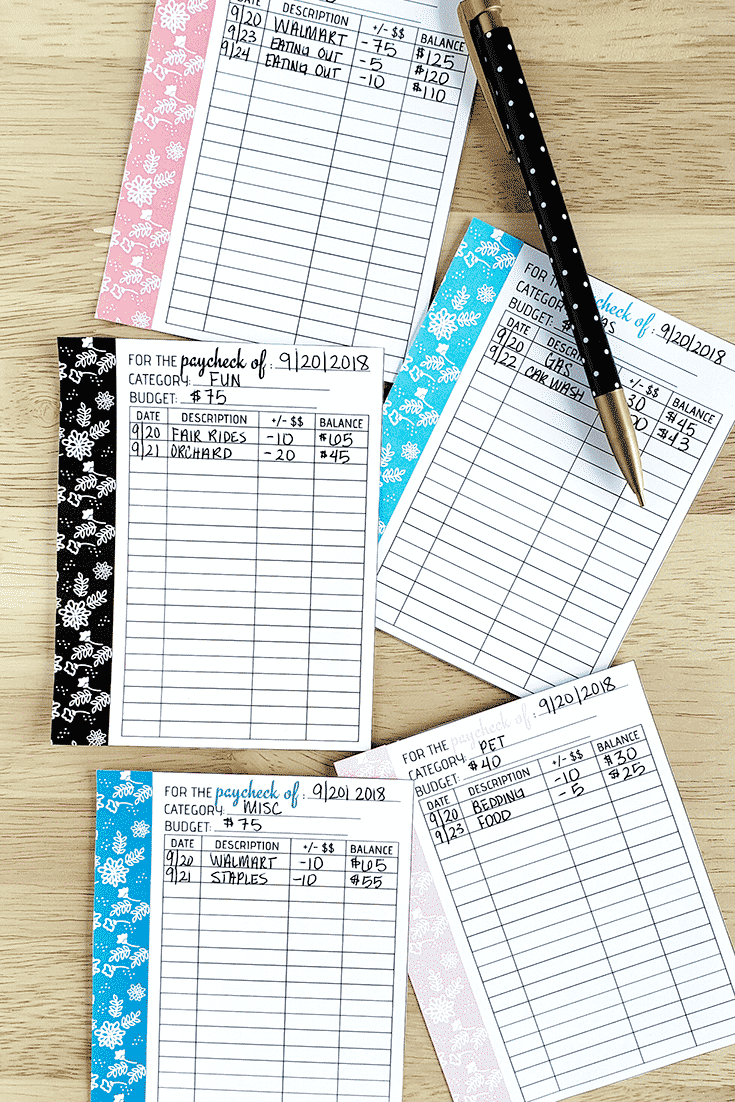

- It’s harder to track your money: From a budgeting perspective, it’s much harder to track your money when you cut out cash. For many people, the cash envelope system is one of the easiest ways to get their spending in order. It’s not impossible to do this with an electronic tracking system, but it’s harder.

- It’s easier to overspend: Many financial experts recommend using cash because it’s harder to overspend with cash. In comparison, it’s much easier to overspend when all you have to do is swipe your card. This could exacerbate financial problems for a lot of people.

- Economic inequality: Not everyone has a bank account, and a cashless society would hurt many people. There are also a lot of people who can’t afford to buy a smartphone. Unless a special effort is made to help these individuals, the economic gap could become wider in the coming years.

- Less privacy: If you rely solely on electronic payments, you’re sacrificing some of your privacy in the process. You can’t spend anonymously if you give up the notion of paying with cash.

- Possible security issues: Cybersecurity is a growing problem, and it’s only going to get bigger with a shift to a cashless society. Even if your money is returned to you, being the victim of a data breach will cause a lot of short-term problems.

Bottom Line

It seemed like the reality of a cashless society was many, many years away just six months ago. But thanks to the effects of COVID-19 and the rapid shift to e-commerce transactions, it could happen a lot sooner than many of us previously believed.

What’s your take on a cashless society? Are you a fan of the idea, or do you think the cons outweigh many of the benefits?