Every investor has the same basic question: how much money can I expect in return, and how long will it take? The Rule of 72 is a simple mathematical formula you can use to estimate how long it will take to double your investment.

Whether you’re investing in stocks, bonds, or even CDs (Certificates of Deposit), the Rule of 72 can be applied!

How Does the Rule of 72 Work?

It’s simple!

The equation can be best described as:

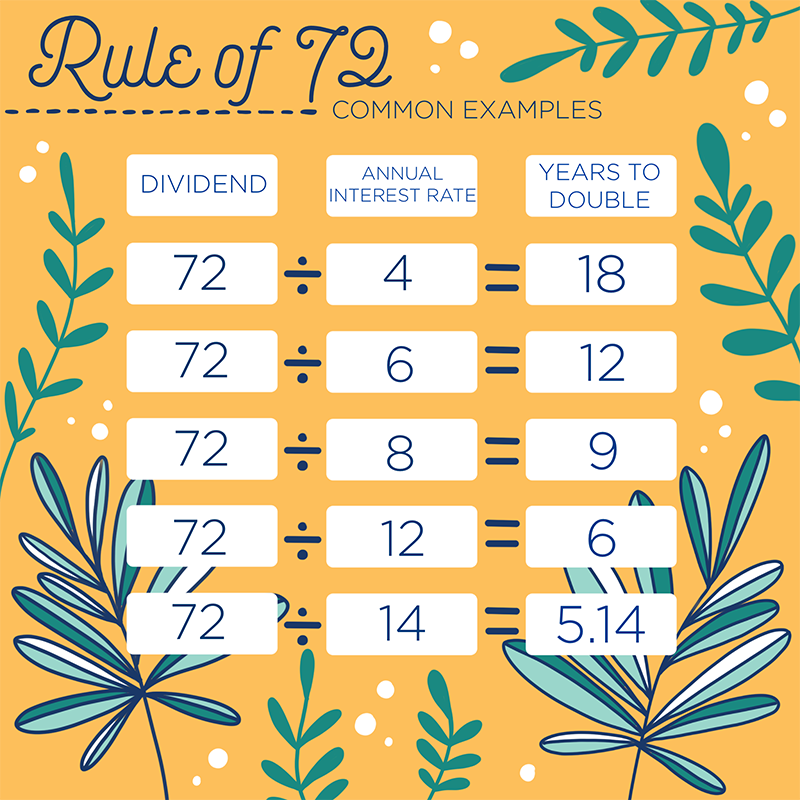

72 ÷ interest rate = how long it will date to double your investment.

Some investments, such as CDs and fixed annuities, have fixed interest rates. Simply use that rate for the equation. Other investments like the stock market, however, have variable interest rates. Historically, the 30-year return of the S&P 500 has been around 12 percent. More conservative investors might want to use 8 or even 6 percent for their calculations.

It’s important to note that the interest rate should not be converted into decimal format as it would be in other equations.

Let’s walk through an example together.

If you’re invested in mutual funds and are averaging an annual interest rate of 12 percent, it would take you 6 years to double your investment.

72 ÷ 12 = 6.

Below is a chart that shows the most common interest rates that investors encounter.

If you enjoy math and want to dig deeper into investment performance, you can also modify the Rule of 72.

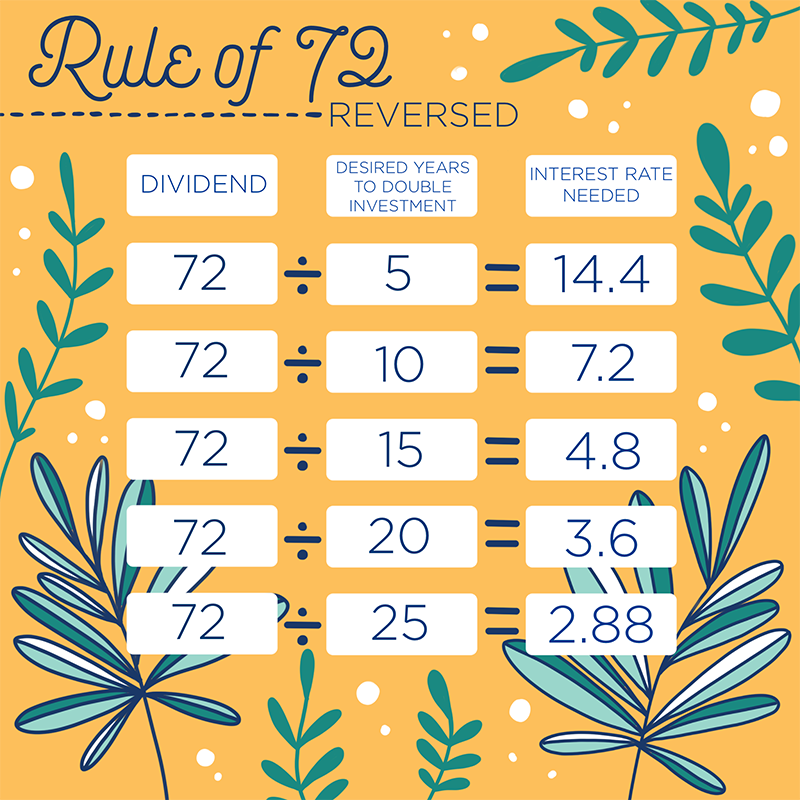

One of the most common variations is to simply reverse the equation.

72 ÷ Desired Years to Double Investment = Annual Interest Rate Needed

This modified version of the equation is good if you have a long term savings goal. For example, if you’re saving for a down payment of a house, saving for your children’s college tuition, or saving for retirement, this equation can show you what interest rate you’ll need to reach your goals.

Below is a table showing the Rule of 72 in reverse.

Why Does the Rule of 72 Matter?

Whether you’re a new investor or a seasoned veteran, the Rule of 72 demonstrates the power of compound interest. After all, the point of investing is to put your money to work for you!

There are many reasons why the Rule of 72 is one of the most popular equations in financial management:

- It’s simple to use. Learning how to calculate compound interest accurately is a complex mathematical challenge. Many variables in the market can impact your return on investment. The Rule of 72 strips away the complexities to help you understand the core numbers crucial to your financial performance. You don’t have to be a financial advisor to be able to utilize this equation!

- It can help you make wise financial decisions. Good investors never jump into an investment opportunity blindly. It’s important to ask questions about historical performance, expected performance, and the fundamental strength of the investment itself. The Rule of 72 can help you ask those shrewd questions before making important money decisions. You’re less likely to fall for gimmicks or scams once you understand how the numbers work!

- It shows that even 1 percent is important. One percent might not sound like a big deal, but when you use the Rule of 72, it’s easy to see how even 1 percent can add years to how long it will take to double your investment. Investors that regularly evaluate their numbers are more likely to maximize investment performance.

- It can be used to calculate credit card interest. Sure, the Rule of 72 can work for you, but it can also work against you! Most credit cards have an interest rate between 17 and 24 percent. This means it would take anywhere from 3 to 4.2 years for your debt to double! Using this equation can help motivate you to pay off your credit card balance in full every month. If that’s not possible, you’ll at least want to pay more than the minimum due.

Amid all the investment calculators and equations out there, all you need is the basic Rule of 72 to predict your investment performance. You can utilize this equation to assess how long it will take your investments or debts to double!

Are There Any Downsides to the Rule of 72?

While the Rule of 72 is simple to use, its simplicity is a trade-off for nuance.

For example, the stock market never produces a fixed interest rate. It’s returns can vary wildly from year to year, especially when there’s uncertainty in the economy. The Rule of 72 will still provide an accurate ballpark estimate, but there will be a small margin of error.

Some mathematicians also argue that the Rule of 72 is excellent for interest rates between 6 and 10 percent, but anything outside of that range will impact accuracy.

For a more accurate calculation, mathematicians say to use 8 percent as the baseline.

In other words, 72 ÷ 8% = 9 years. This is the most accurate “baseline” of the equation.

But for every 3 points that the interest rate differs from 8 percent, then you’ll want to adjust the original “72” by 1 point in that same direction.

For example, if the interest rate is 11 percent, that’s 3 points higher than the baseline of 8. So instead of 72, we’ll want to add 1 to make the dividend 73. Now the equation is 73 ÷ 11% = 6.6 years.

If the interest rate increases to 14 percent, that’s now 6 points higher than the baseline of 8. Now, we’ll add 2 to 72, making the equation 74 ÷ 14% = 5.29 years.

On the other hand, if the interest goes down 3 points, you’ll want to subtract 1 from 72. In the case of 5 percent (3 points lower than 8), you’ll want to subtract 1 from 72, so the equation changes to 71 ÷ 5% = 14.2 years.

What New Investors Should Know About the Rule of 72

The Rule of 72 is an excellent rule of thumb to estimate how long it will take for your investment to double.

Of course, there is never a one-size-fits-all solution. We all have different financial circumstances, goals, and projected returns on investments. Partnering with a licensed financial advisor who has your best interest at heart is key to truly maximizing your financial potential.

View the Rule of 72 as a “jumpstart” to understanding investment performance and how long it will take you to achieve your goals.

However, at the end of the day, the Rule of 72 can only work in your favor if you’re living on a balanced budget! As fun as it is to calculate equations, the only surefire way to achieve your financial goals is to work towards them, step by step.

Are you paying off your debt? Are you living within your means? Are you investing a little bit of your income every paycheck to save for the future? Continue to practice good financial habits to make sure that the Rule of 72 works for you!