Editorial Disclosure

Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed or approved by any of these entities.

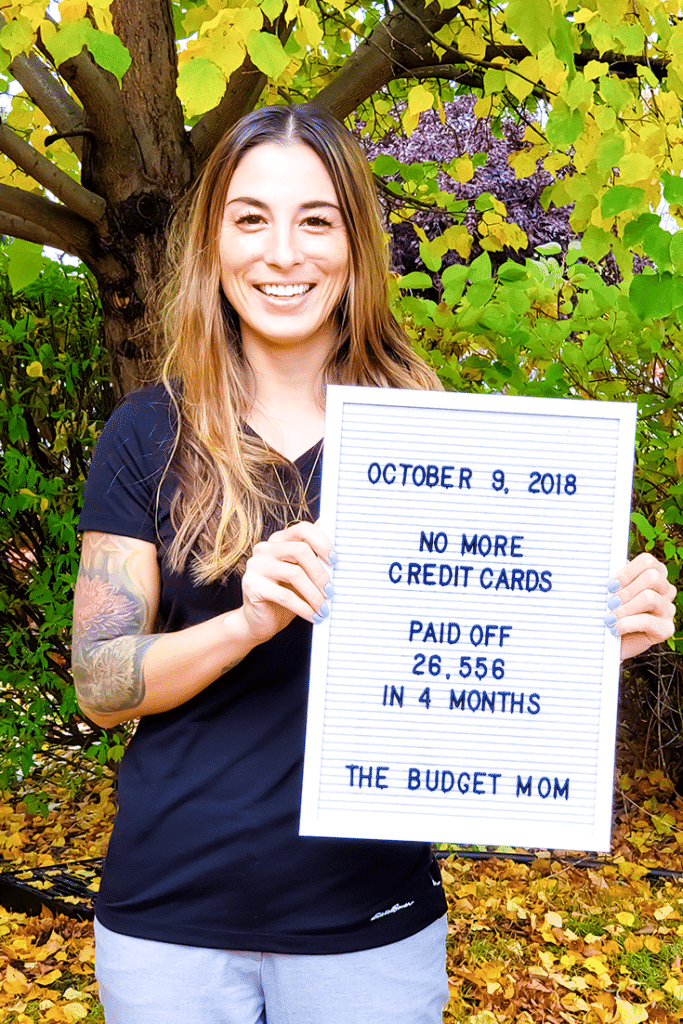

Is one of your financial goals to get out of debt? If so, opening another credit card could be the worst – or best – option you have. Personally, I used this strategy to help me knock out over $26,000 View Post