A budget is the most personal thing you will ever create. It’s honestly a reflection of your life, your wants, your goals, and your dreams. Not only that, but your budget can tell you some pretty incredible things about your money.

The process of closing out your budget (figuring out where your money went during the month) is so important. It’s going to show you where your money went, what categories you should be using in your budget and for your cash envelopes, and how much to assign for your budget categories realistically.

It will also show you if your spending is aligning with your financial goals, and what progress you are making. Don’t just blindly follow a budget. Understand the reasons behind your financial choices, and look at what your budget tells you.

MY FEBRUARY 2019 BUDGET RECAP

Why do I show you my budget recaps? One of the things that lacked when I was learning how to budget were real-life examples. I was tired of looking at “made-up” numbers or one-sided examples. I wanted to know what it looked like for a real person to successfully use a budget in their life. Not only that, I wanted to know their decision-making process and understand why they were making the decisions they were making.

I hope that by sharing my real numbers and budget with you, that you will start to understand those psychological aspects behind successful budgeting.

WHERE DID MY MONEY GO?

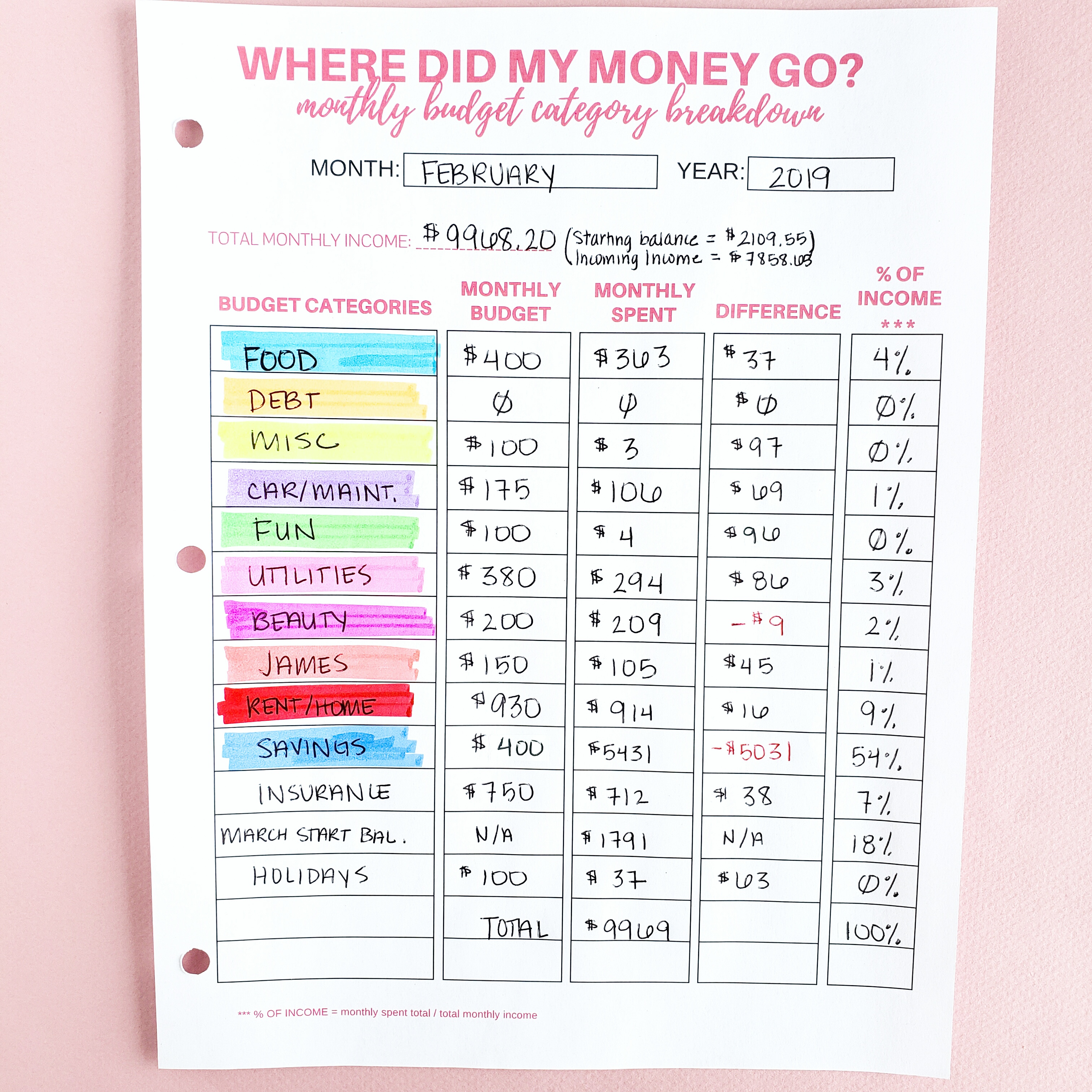

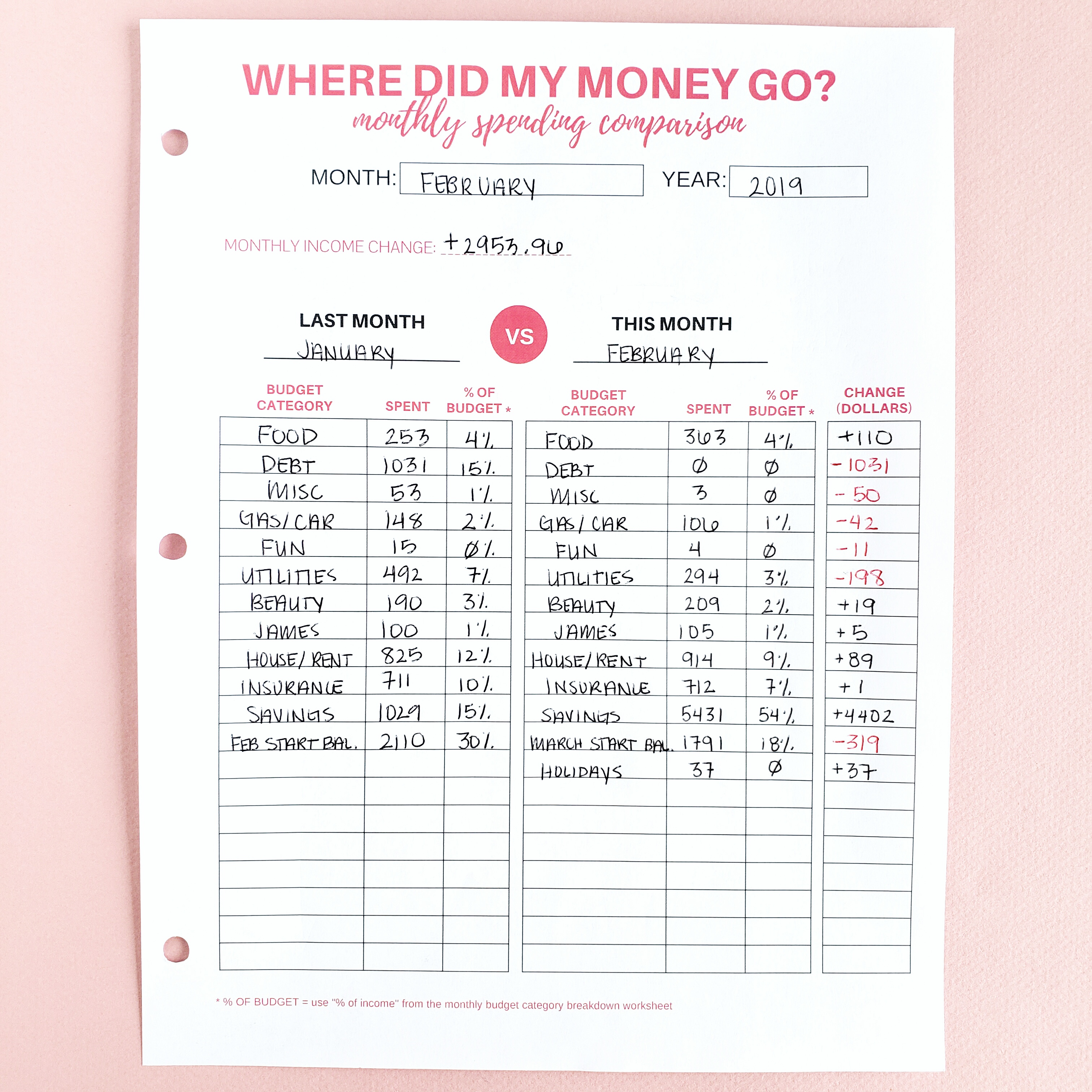

At the end of every month, I take all of the information from my expense trackers, and I organize my spending into categories. Now, I have been budgeting for a very long time, so I use the same categories over and over. If you are just starting out, organizing your spending into categories that make sense to your life, might take some time and tweaking.

I track my budget from the first of every month to the last day of the month.

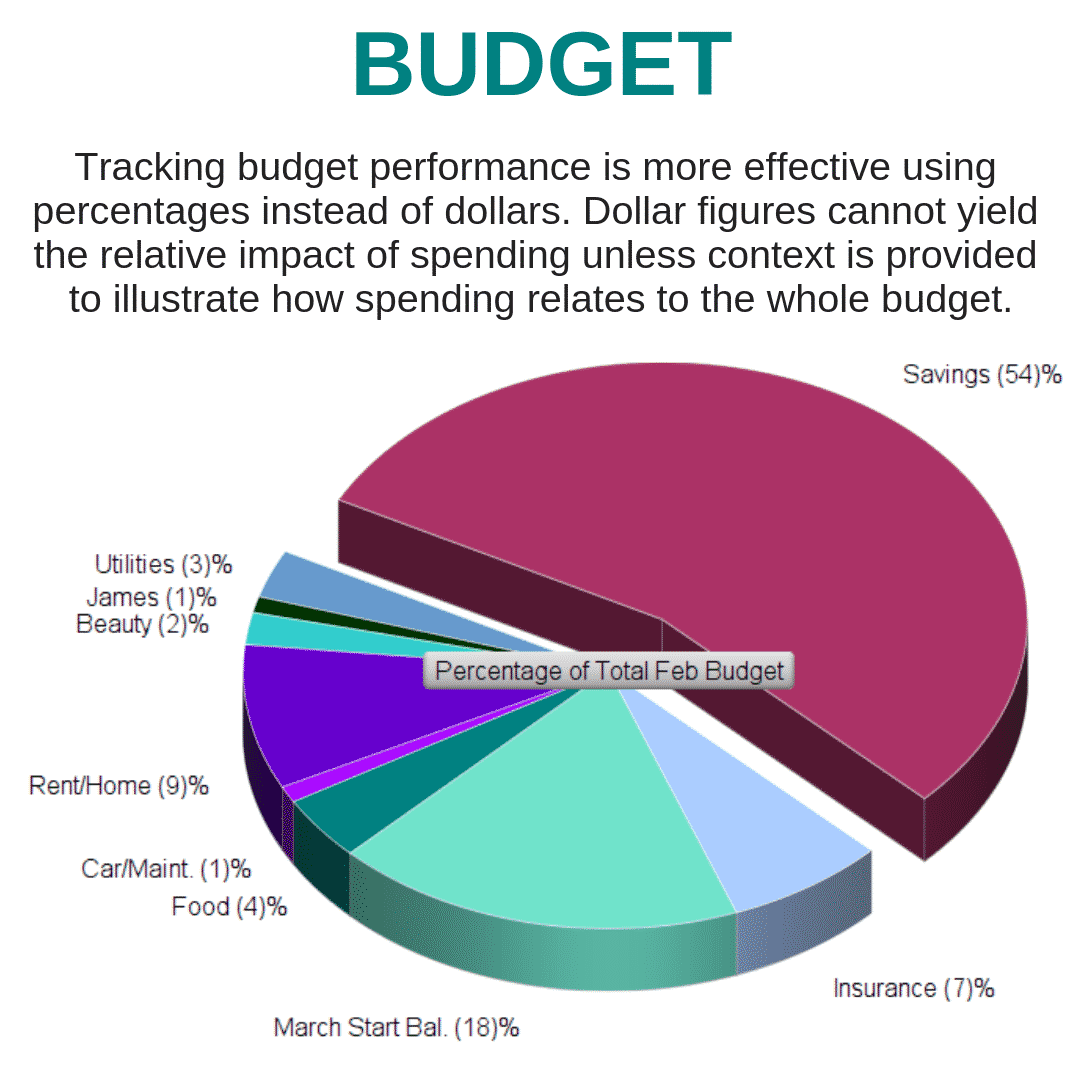

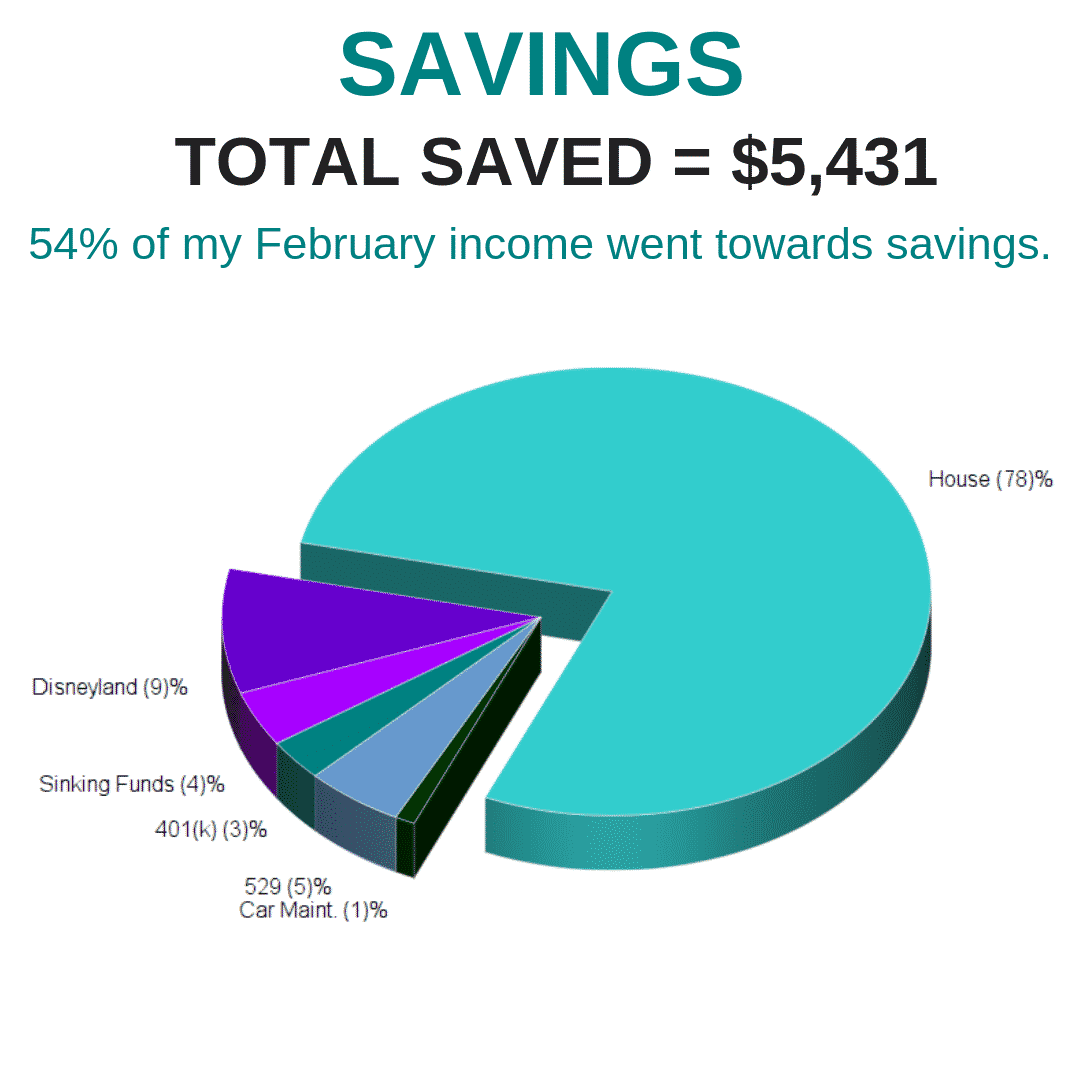

Even though I budget my income by paycheck, I still like to assign a monthly budget for each one of my categories. For February 2019, my most significant expense was savings. 54% of my income went towards my savings goals.

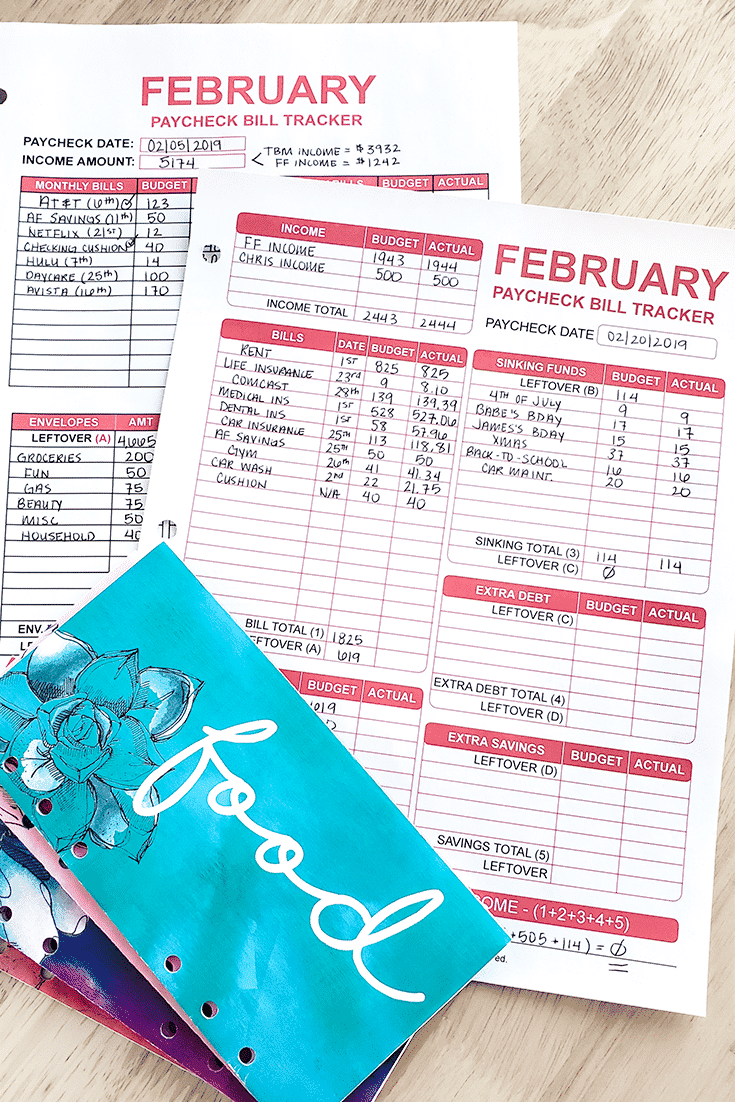

There were some massive changes to my budget in February. After leaving my full-time job, I now get paid once a month, instead of on the 5th & 20th. February was a month where I transitioned into my new pay schedule. Even though I get paid on the last day of every month, I have made the decision to count that paycheck for the 1st of every month. I struggled with this decision for a while, but ultimately decided it would make budgeting easier for me. I get paid on the 1st, and that paycheck would now cover all of my monthly expenses for the entire month.

I also completed the No Eating Out February Savings Challenge, and it was a huge success! I only spent $363 out of my $400 monthly food budget. My food budget includes eating out and grocery trips. I didn't do well with meal planning in February but still came under budget.

I like to know if I was over or under my monthly budget. If I was over, I mark that amount with a “+” sign and write it in black. If I came under budget, I mark it with a “-” sign and write it in red. This allows me to see how I did with overspending.

I use a zero-based budget, which means my “budget” is really just a sum of my income. So some months, my income decreases or increases. My spending will always reflect those fluctuations.

THE STARTING BALANCE

A starting balance is something that will always be listed on my budget recaps. I like to keep extra money in my checking account at all times, which I call my “checking account cushion.” When you are working with a zero-based budget, all of your income is essentially being used. If you are using a zero-based budget correctly, that means you should have no money left in your checking account, because it should all have a plan for your spending on your budget.

When I first started using the zero-based budget, the idea of bringing my checking account down to $0 every month freaked me out. My cushion allows me to have extra money just in case a bill is higher than expected, or I have an unexpected expense that I need to cover. I also use my cushion for any unanticipated online purchases that I make, and then I replenish my cushion using the cash I have from my envelopes.

Some people call their starting balance “savings” or “beginning balance” but I have it labeled in my worksheets as “starting balance.”

Do you use the last paycheck of every month to cover some of the bills for the beginning of the next month? For example, your January 20th paycheck will be used to pay for some bills on February 1st, like rent. By carrying over this starting balance into the new month, you will have the income to cover those expenses.

For my monthly income, I use starting balance plus incoming income.

HOW MUCH WENT TO DEBT AND SAVINGS

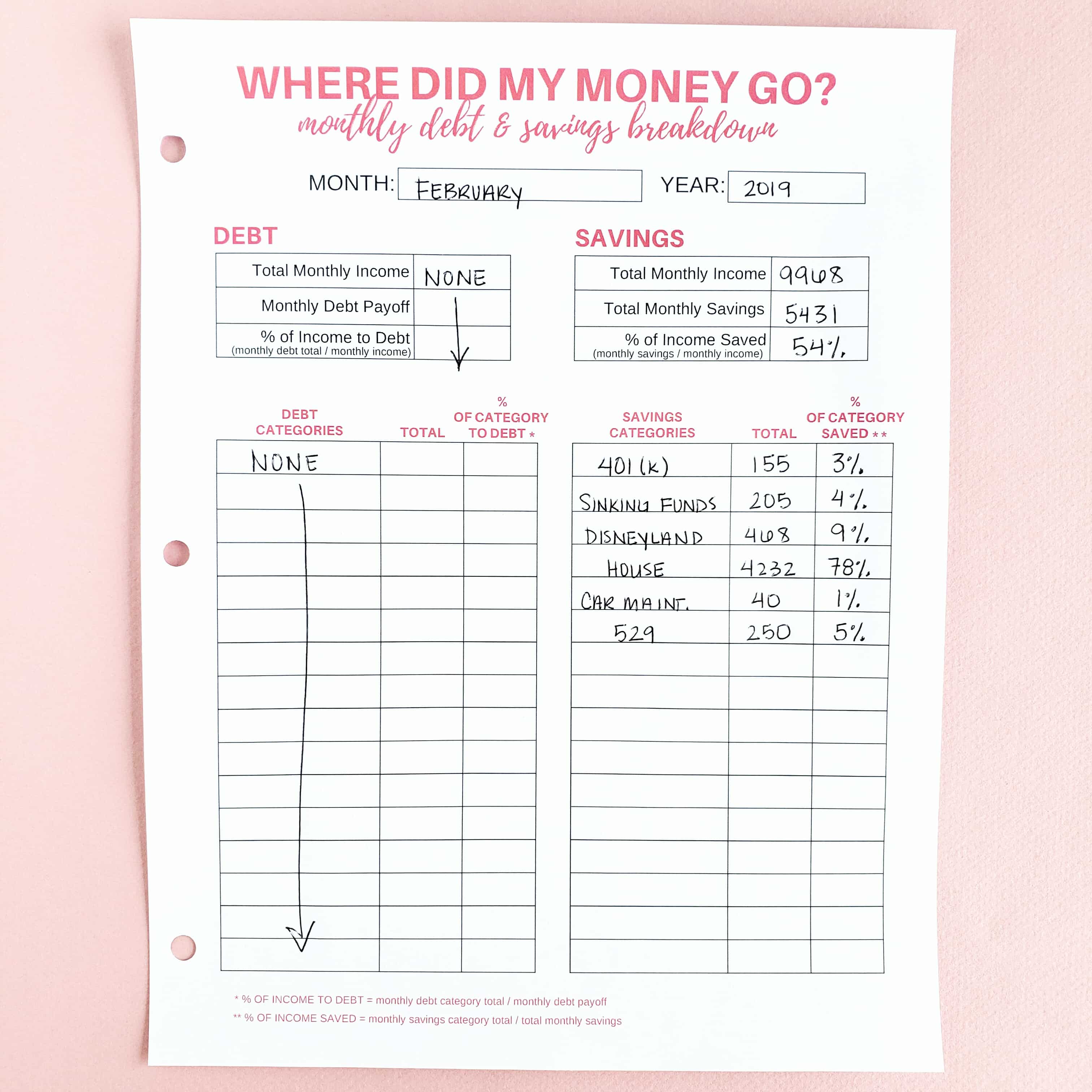

I like to keep track of my financial goals. Yes, it’s nice to know how much went to savings for the entire month, but I want to know what am I saving for. What savings goals am I currently spending money on?

Same with debt. I don’t want to know how much total went to debt during the month, but what specific debts am I paying off?

$5,431 (or 54%) of my monthly income went towards savings in February. Out of the $5,431 that I saved, 78% went towards my house savings account.

February will be the last month that I have income going to my day job's 401(k). Since I am now working for m business full-time, I will start making regular retirement contributions to my business's 401(k) plan in April. I have decided to roll over my 401(k) with my previous employer to my new 401(k) for my business.

I use sinking funds in my budget to help me save for the future. You can read about why you should start using sinking funds in this article. In February, I added more sinking funds to my budget, so I have the cash to cover future holidays, events and occasions happening in 2019.

HOW DID MY SPENDING COMPARE TO LAST MONTH

Every month, I like to look at how my spending compared to the previous month. It helps me answer the question, “Did I make progress or decrease my spending in certain categories?”

The one category I am always fighting is my food budget. This is the one category I like to look at. I always try to challenge myself to spend less, and I want to make sure that my spending is going down or staying the same from month-to-month, not increasing.

If your income fluctuates every month like mine does, it’s also an excellent way to see where you are compensating in your spending for those fluctuations. For example, in February my income increased by $2953 due to my first self-employment check getting deposited on the 1st of the month. The question I like to answer is, “if my income increased in February, where did I spend that extra income to compensate for the increase?”

For the change in dollars, I write it in red if I spent less than the previous month, and I write in black if I spent over what I spent in the last month.

![]()

In February, I was able to save $4232 for my House Savings Goal. Currently, I am saving to buy my first home with cash. That brings my total House Savings to $6,100 total.

MY DECEMBER 2019 BUDGET RECAP

I made a lot of progress in December, and I am very excited to see my growth in 2019.

There are two fundamental things that I have learned on my financial journey.

One. There is no wrong or right way to budget your money. The right way is the way that works for you. It doesn’t matter what the financial experts are out there telling you or what you might be reading about budgeting. You have to do what works for you and your unique life.

I get asked all the time why I choose to save money while I am on a debt payoff journey. I get judged a lot because it’s not what Dave Ramsey would do. So my simple answer – it works for me and my financial goals. Don’t be afraid to budget outside of the box, and do things that you feel are right for you and your family.

Two. Being on a debt free journey doesn’t just mean making debt payments. Your budget is just as important as paying off debt. It’s about having a system in place to ensure that you don’t go into debt in the future. What are you doing today with your money that ensures you won’t have to use debt later?

You can get the worksheets shown in this recap here:

2019 Budget-by-Paycheck Workbook: https://www.thebudgetmom.com/product/the-2019-budget-by-paycheck-workbook/

“Where Did My Money Go” Worksheets: https://www.thebudgetmom.com/product/where-did-my-money-go-worksheets-printable/