If you are reading this, you are probably thinking to yourself, "This just isn't possible." Today, I hope that my story inspires you to take action in your own debt journey, to feel hope, and to View Post

Archives for January 2019

10 Legitimate Ways to Make Extra Income from Home

Living on a budget is great. Unless, of course, it’s not. Because sometimes even living within your budget calls for more money than you’re bringing in. Maybe the transmission is going out two View Post

Should You Consolidate Your Debt?

Editorial Disclosure

Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed or approved by any of these entities.

If you are wallowing in debt from credit cards, student loans, and medical bills, it probably seems that ads for debt consolidation companies are everywhere. At least you’re very aware of View Post

User Generated Content Disclosure

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Save Money Meal Planning: The Freezer Challenge

A couple of months ago on TBM, I shared a new savings challenge with you. As I was doing my meal planning at the beginning of November, I was overwhelmed by how much food I had in my house! I View Post

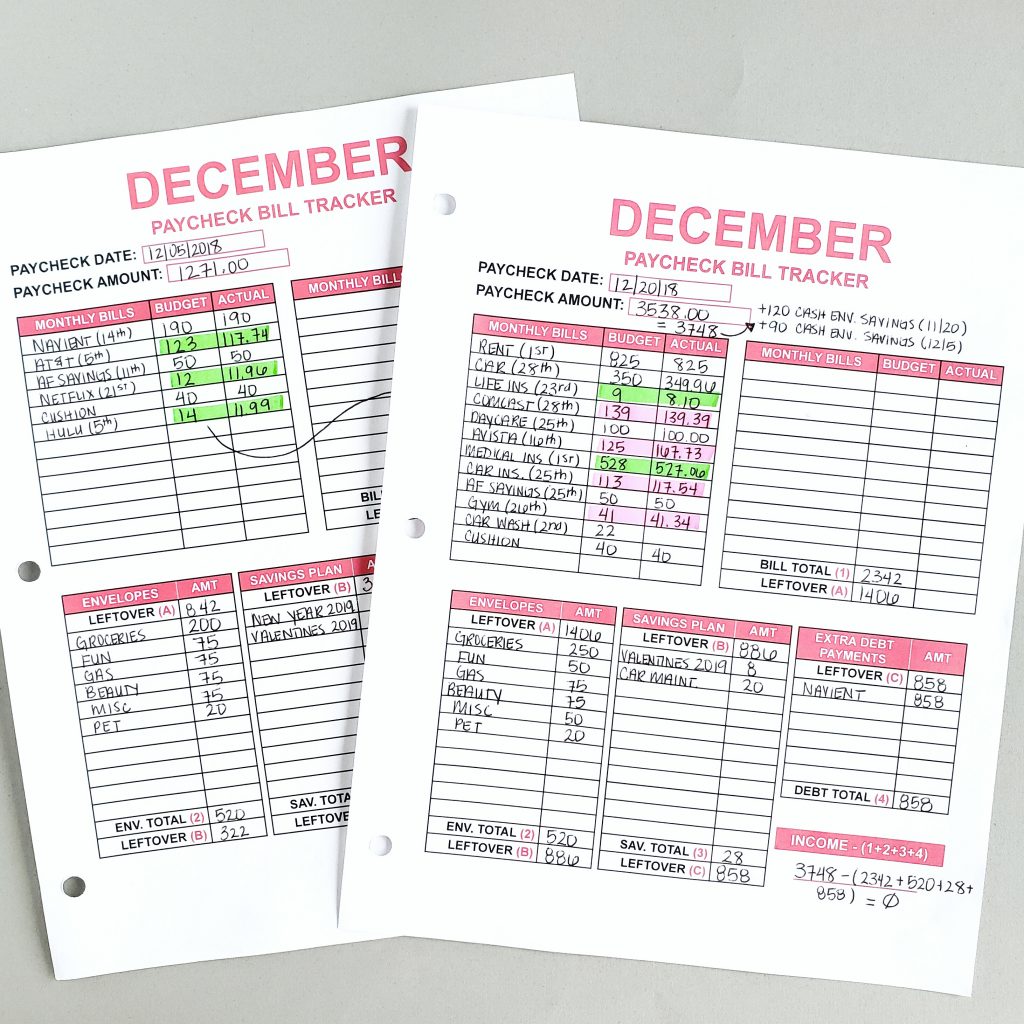

December 2018 Budget Recap

If you have been following me on Instagram, then you are familiar with my full (very detailed) budget overviews and recaps. Every month, I like to share how I make realistic budgeting successful in my View Post